The UK’s Best- Value Table Booking System

- Only £75/month and unlimited covers!

- No per-cover charges or hidden fees

- Boost bookings by 15-20%

- Reduce no-shows with integrated deposits

- Google Reserve and Stripe partner

- Simple to set up and use – start taking bookings in 48 hours!

The UK’s Best-Value Table Booking System

- Only £75/month and unlimited covers!

- No per-cover charges or hidden fees

- Boost bookings by 15-20%

- Reduce no-shows with integrated deposits

- Google Reserve and Stripe partner

- Simple to set up and use – start taking bookings in 48 hours!

Make restaurant booking easy for you and your diners with our real-time online booking and table management system.

Flexible, easy to use and with no per-cover charges our online table reservation system increases bookings and revenue. From deposits to table management, Sugarvine Tables is the cornerstone of seamless table reservations for customers and restaurateurs alike.

Make restaurant booking easy for you and your diners with our real-time online booking and table management system.

Flexible, easy to use and with no per-cover charges our online table reservation system increases bookings and revenue. From deposits to table management, Sugarvine Tables is the cornerstone of seamless table reservations for customers and restaurateurs alike.

What makes Sugarvine Tables the UK’s best?

Get More Covers

24/7 bookings through your website, social, Google Reserve and Sugarvine dining guide.

Low Cost

The best-value online booking system on the UK market just £75 plus VAT/month.

Reduce Admin

Automated booking system means far less calls, messages and emails.

Easy To Use

Simple interface for diners and operators and go live in just 48 hours.

.

Loved By Restaurants

Check out our reviews on TrustPilot and Google to see why.

1-2-1 Support

Connect by email and mobile and get a direct response from our UK-based support team.

How much could you save right now by switching to Sugarvine Tables?

Are you paying too much with booking providers like ResDiary, OpenTable, The Fork and SevenRooms? Enter your current monthly cost, including fees, and find out how much you’d save by switching to Sugarvine Tables!

Switching is easy! You could be taking bookings on Sugarvive Tables within 48 hours!

Total Monthly Cost

How our table booking system works

Table Booking System

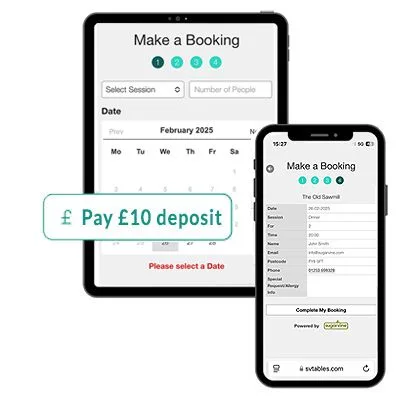

Our table reservation system looks and books the part, making table booking easy, slick and timely for you and your customers.

Booking can be taken directly from your social media accounts, your website, Google Reserve and our dining guide Sugarvine.com to ensure you are in front of your customers whenever and wherever they are looking to book.

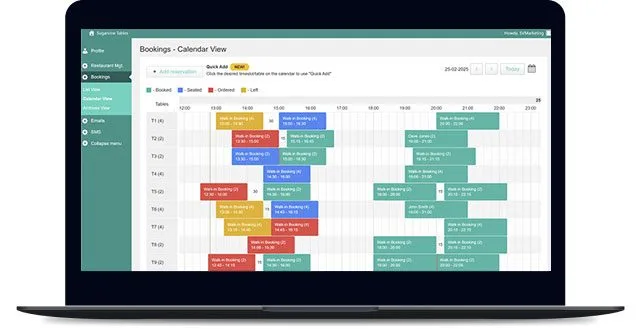

Table Management System

Reduce admin, boost efficiency and save time with our table management system.

Online Deposits

Bookings failing to turn up can costing you a fortune in empty tables and missed revenue. We partner with Stripe for out payment and deposits system which allows you to take deposits or hold card details at the booking stage and customise how it works for specific days, times or group sizes. That way, you can secure covers and reduce the chance of no shows, thus protecting your revenue.

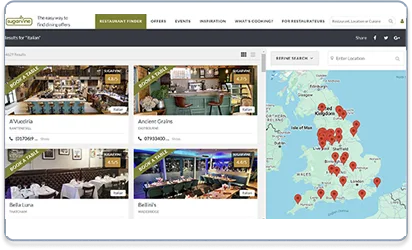

Sugarvine Dining Guide

We get you more bookings at no extra cost by featuring your venue in our dining guide, Sugarvine.com.

We’ll showcase your offers, events, and mouth-watering dishes to a wider audience through our high-traffic dining guide and active social media channels. Reach more potential customers, increase your visibility, and fill your tables without spending extra. Let Sugarvine help grow your business.